Last updated on March 31, 2013

How does commodity price volatility affect the welfare of rural households in developing countries, for whom hedging and consumption smoothing are often difficult? And when governments choose to intervene in order to stabilize commodity prices, as they often do, who gains the most? This article develops an analytical framework and an empirical strategy to answer those questions, along with illustrative empirical results based on panel data from rural Ethiopian households. Contrary to conventional wisdom, we find that the welfare gains from eliminating price volatility are increasing in household income, making food price stabilization a distributionally regressive policy in this context.

That’s the abstract of an article Chris Barrett, David Just, and I have been working on since 2007, and which has just been accepted for publication by the American Journal of Agricultural Economics.

In this article, we ask the question: What is the effect on rural households of increasing the uncertainty (i.e., volatility) surrounding the prices of the staple crops they produce and consume, holding the levels of those same prices constant? In other words, we isolate the impact of an increase in the variance of a price distribution holding the mean of that price distribution constant, and we look at the effects of the covariance between each pair of prices, since a price never varies alone.

To answer those questions, we use publicly available survey data from rural Ethiopia and study the welfare impacts of volatility in the prices of coffee, maize, beans, barley, wheat, teff, and sorghum.

This article, I think, is my best piece of research so far, and it is not without reason that I used it as my job-market paper this year. It really has everything one wants one’s research articles to have:

- A theoretical contribution: We extend the study of attitudes to price risk to agricultural households producing and consuming multiple commodities, thereby combining the approaches in Turnovsky et al. (1980) and in Finkelshtain and Chalfant (1991).

- An empirical contribution: We develop a method to estimate the welfare impacts of price volatility for a number of commodities using survey data, and

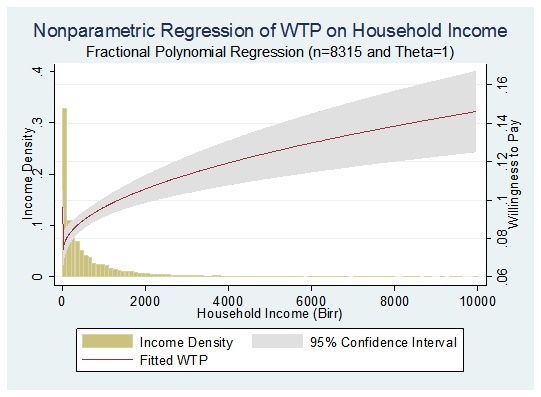

- A policy contribution: We find that although the average household in the data incurs a welfare loss from being exposed to commodity price volatility, that welfare loss is increasing in household income, as the following figure illustrates.

What this really means is that the households in the data would be willing to give up a significant fraction of their incomes to eliminate the uncertainty surrounding the prices of the seven commodities we retain for analysis, and that fraction is increasing as income increases.

But recall that conventional wisdom has it that price volatility mostly hurts the poor in developing countries. Our findings, which are robust to changes in specification, indicate that that’s not true.

The reason behind our counterintuitive finding is simple: Wealthier rural households in Ethiopia are more likely to resemble pure producers of textbook microeconomic theory, and though the impact of price uncertainty on consumers cannot be determined a priori, the impact of (output) price uncertainty on producers has been well-known since Sandmo (1971): As the uncertainty surrounding output price increases, producers increasingly hedge against price risk by decreasing the quantity they produce.